Why Commercial Mortgage Rates Are Higher Than Residential

Nov, 16 2025

Nov, 16 2025

Commercial DSCR Calculator

Calculate Your Debt Service Coverage Ratio

Commercial mortgages require a Debt Service Coverage Ratio (DSCR) of at least 1.25 to qualify. This calculator helps you determine if your property meets lender requirements.

Your Debt Service Coverage Ratio:

--

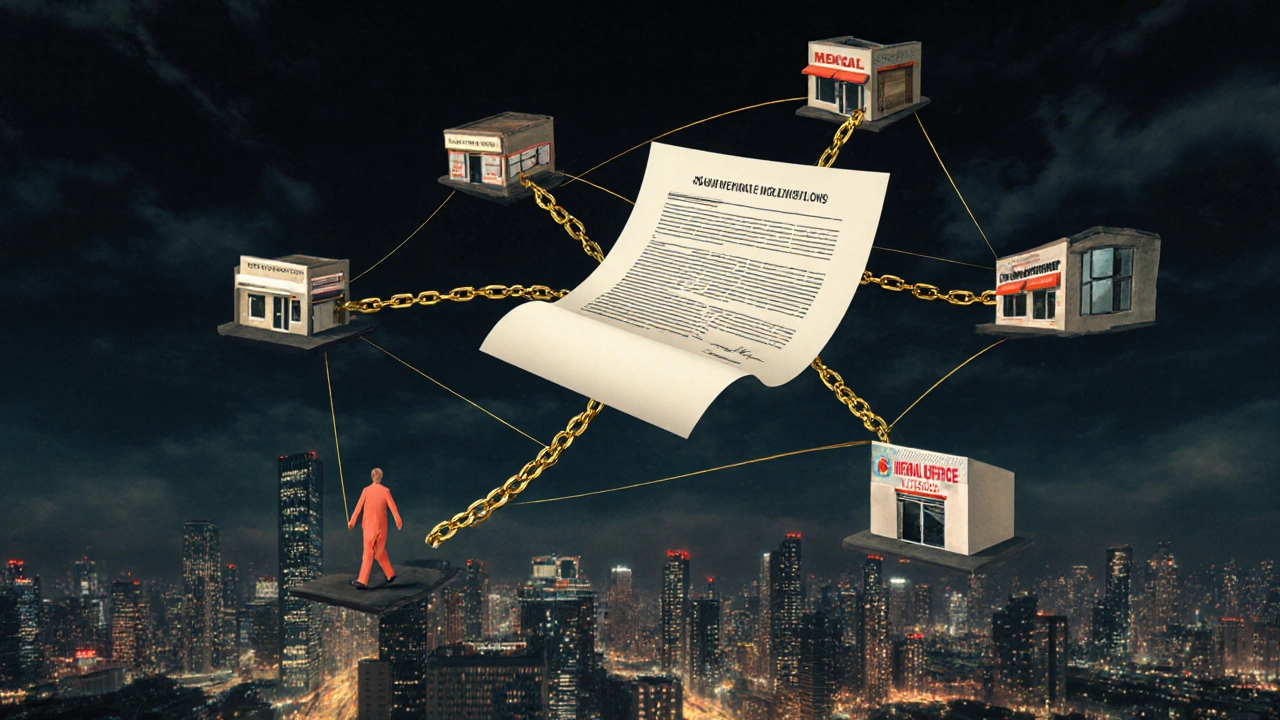

If you’ve ever shopped for a loan to buy an office building, warehouse, or retail space, you’ve probably noticed something frustrating: commercial mortgage rates are almost always higher than residential ones. Even if you have excellent credit and a solid business, you might still pay 1.5% to 3% more than someone buying a house. It’s not a personal slight-it’s built into how lenders see risk. Here’s why.

Lenders see commercial properties as riskier investments

When you buy a home, you’re likely living in it. That changes how lenders think. If you fall behind on payments, you’re not just losing an asset-you’re losing your roof. Most people will do almost anything to keep their home. That’s why residential loans have such low default rates-around 0.5% in the U.S. and similar in New Zealand.

Commercial properties are different. A tenant might move out. The local economy might shift. A retail center could sit empty for months while the owner scrambles to find a new lease. Lenders know this. A commercial loan isn’t tied to a person’s life-it’s tied to a business’s performance. And businesses fail. In 2024, over 12% of small commercial properties in major New Zealand cities experienced vacancy rates over 15% for more than three months. That’s a red flag for any lender.

Loan terms are shorter and require larger down payments

Residential mortgages often run for 25 to 30 years. Commercial loans? They’re typically 5 to 15 years. Many are structured as 5-year loans with a balloon payment due at the end. That means the borrower has to refinance or sell the property in a short window.

Why? Because lenders don’t want to be stuck with a property that might be worth less in 20 years. A 30-year loan on a house is predictable. A 30-year loan on a strip mall? The tenant mix, zoning laws, and even traffic patterns could change completely. So lenders demand shorter terms to reduce exposure.

Down payments are higher too. For a home, 10% to 20% is common. For commercial property, lenders usually require 25% to 40%. That’s because they want you to have more skin in the game. If you’ve put up $500,000 of your own cash on a $2 million building, you’re less likely to walk away when things get tough.

Commercial loans are not backed by government programs

Most residential mortgages in New Zealand and the U.S. are either sold to government-backed entities like Fannie Mae or supported by state housing agencies. These programs guarantee a certain level of repayment, which lets banks lend at lower rates.

Commercial loans? No such safety net. There’s no government program that buys commercial mortgages at scale. That means banks have to carry the full risk on their books. To make up for that risk, they charge higher interest.

Even when commercial loans are securitized, they’re bundled into private investment vehicles-not government-insured pools. That means investors demand higher returns, and those costs get passed down to borrowers.

Underwriting is more complex and expensive

Getting a home loan involves checking your income, credit score, and employment history. Done in a few days.

Getting a commercial loan? It’s a full audit. Lenders want:

- Three years of business financial statements

- Lease agreements for every tenant

- Occupancy rates over the past 12 months

- Property condition reports

- Environmental assessments

- Market analysis for the area

That’s not just paperwork-it’s time, expertise, and legal review. A residential loan might cost a bank $500 to process. A commercial loan? $5,000 to $15,000. Those costs don’t vanish. They get added to the interest rate.

Property values are harder to predict

House prices move with interest rates, population growth, and school zones. Commercial property values? They move with tenant quality, lease length, and local economic trends.

Think of it this way: a house in a good neighborhood will hold its value even if the economy dips. But a retail space in a mall that’s losing foot traffic? Its value can drop 40% in a year. Lenders know that. So they build in a buffer-higher rates-to protect themselves if the property’s value crashes.

In Wellington, for example, office space in the central business district saw a 22% decline in valuations between 2022 and 2024, largely due to remote work trends. That kind of volatility scares lenders. They respond by raising rates across the board.

Interest rates are tied to the property’s cash flow, not your personal income

For a residential loan, your salary is the main factor. If you earn $90,000 a year, you can probably qualify for a $600,000 mortgage.

For a commercial loan, your personal income barely matters. What matters is whether the building makes enough money to cover the mortgage, taxes, insurance, and maintenance. That’s called the debt service coverage ratio (DSCR).

Lenders want a DSCR of at least 1.25. That means the property’s net income must be 25% higher than the annual loan payment. If a building brings in $120,000 a year in rent but costs $95,000 to run, the net income is $25,000. If the loan payment is $20,000, the DSCR is 1.25-barely acceptable. If the DSCR is lower, the lender will either reject the loan or raise the rate to reduce the payment amount.

This makes commercial loans more sensitive to market shifts. A single tenant leaving can push your DSCR below the threshold. That’s why lenders demand higher rates-to give themselves room to absorb those kinds of surprises.

There’s less competition among lenders

There are hundreds of banks and lenders competing for residential mortgage customers. You can compare rates on 10 different websites in five minutes.

Commercial lending? It’s a much smaller club. Only a handful of banks and specialized finance companies offer these loans. That lack of competition means less pressure to lower rates. In New Zealand, just five institutions handle 70% of all commercial real estate financing. With fewer players, pricing power stays with the lenders.

What can you do about it?

Higher rates aren’t a dealbreaker-they’re a reality. But you can reduce the gap:

- Put down more cash. A 40% down payment can cut your rate by 0.75% or more.

- Get long-term tenants. A lease with a creditworthy company (like a pharmacy or bank) for 10+ years improves your DSCR and lowers perceived risk.

- Keep the property well-maintained. A clean, modern building attracts better tenants and holds value.

- Work with a commercial mortgage broker. They know which lenders are more flexible and can match you with the right deal.

- Consider SBA-style loans if available. In some countries, government-backed commercial programs exist-though New Zealand has fewer options than the U.S.

It’s not about fighting the system. It’s about working smarter within it. The higher rate isn’t punishment-it’s insurance. And if you structure your deal right, you can still make a solid return-even with the extra cost.

Why can’t I get a 30-year commercial mortgage like a home loan?

Commercial mortgages rarely go beyond 25 years because lenders want to avoid long-term exposure to unpredictable risks. Tenant turnover, economic shifts, and changing zoning laws can drastically affect a property’s value and income over time. A 30-year loan on a house is low-risk because people need a place to live. A 30-year loan on a warehouse? The tenant might be gone, the industry might have moved, and the building could be obsolete. Shorter terms give lenders more control.

Does my personal credit score matter for a commercial loan?

It matters, but not as much as your property’s cash flow. Lenders check your credit to assess reliability, but the main focus is the debt service coverage ratio (DSCR)-how much income the property generates compared to the loan payment. If the building makes enough money, you can still qualify even with a credit score below 700. But if the DSCR is weak, even a perfect credit score won’t save the loan.

Can I refinance a commercial mortgage to get a lower rate?

Yes, but it’s not easy. Refinancing requires the property to have strong occupancy, stable income, and rising value. If you’ve improved the building or signed long-term leases since you bought it, you might qualify for better terms. But if the market has softened or vacancies have increased, lenders may refuse or demand an even higher rate. Refinancing is possible, but it’s not a guaranteed fix.

Are commercial mortgage rates the same across all types of properties?

No. Rates vary by property type. Office buildings and retail centers usually have higher rates because they’re more vulnerable to economic swings. Industrial warehouses and medical offices tend to have lower rates because tenants are more stable-like logistics companies or hospitals. Self-storage facilities are often the cheapest to finance because they have high occupancy and low maintenance costs. The type of building directly impacts the risk-and the rate.

Is it possible to get a commercial loan with no money down?

Almost never. Most lenders require at least 20% down, and 25% to 40% is standard. Some rare programs allow lower down payments if you’re buying from a family member or if the property has exceptional cash flow-but these are exceptions, not rules. No-money-down commercial loans are a myth. Lenders need to see your commitment through skin in the game.

Commercial real estate isn’t for everyone. But for those who understand the rules, it can be a powerful tool for building wealth. The higher rates aren’t a barrier-they’re a filter. They keep out speculative buyers and reward those who plan ahead, manage well, and choose properties with steady income. If you’re ready to play the long game, the numbers still work.